These days the interest rates on normal bank accounts are low to negative and given the political risk factors, meaning demographic/climate change etc. it is highly doubtable whether you will have a good retirement if you just trust your normal insurance…

My approach to solve this problem is to leverage the stock market.

Before we proceed a disclaimer:

I am no financial adviser and don’t ever intend to be one, but I can tell you what I think about this and what I believe can be done in the simplest way to approach it.

Another disclaimer:

The goal here is not to get rich, but to live a happy life and don’t die poor!

The thing I want to talk about in this post is: Investing on the stock market.

Difference: Investment and gambling

Investing on the stock market has nothing to do with gambling, although of course the stock market can be used for that too.

Investing is for the long-term (15+ years). It is the key strategy for building wealth and financial security. It requires saving money to develop a diversified portfolio of assets (stocks only being one of them) which work for you to drive your wealth forward.

But isn’t the stock market volatile as hell?

Yes it is. Over the short term. Over the long term it did only grow in the past.

There have been huge ugly drawdowns in the past where you lost 50% and more in a few weeks, but over a long term perspective of, let’s say, 20 years a well diversified portfolio never had a negative yield.

Notice the “well diversified portfolio” here: There have been people, especially here in germany, which invested in single stocks of telecommunication providers or car manufacturers, lost a lot, never recovered and therefore shun the stock market like vegans the meat.

But these weren’t diversified! They were gamblers.

Another example: The Japanese stock market peaked in 1989 and the bubble bursted then. It hasn’t recovered until today!

So even owning the stock market of a whole nation wouldn’t have helped you there.

Though this was diversified across sectors (technology, financials, industrial, healthcare, consumer goods, etc.) it wasn’t really diversified across regions.

How can you be diversified enough?

You need to own a significant portion of the whole market capitalization!

If you are diversified with about 80% or more of the total market capitalization, what should happen?

In short time periods (< ~10 years) you can lose. A lot.

The market is volatile and valuations are driven by emotions.

In the long run you should never lose!

(Utterly) simplified scenario: The companies that make up the large parts of the market capitalization lose half of their value for a long period of time.

Meaning that some of the big players on this globe file bankruptcy or lose a lot of revenue.

I am talking about companies like Alphabet, Apple, Microsoft, Facebook, Amazon, Johnson & Johnson, Exxon, Berkshire Hathaway, Netflix, Nestlé,… all the names you know.

Then you can expect some things: You’ll probably lose your job due to the big recession and your retirement savings will probably be used by the government to get the market running again. To get more people into employment in that crisis.

So either the stocks go up again after that, or you’ll have different problems than money anyway. In that case some survival training would have been your best investment.

Since I’m not a doomsday prepper, but an optimist (to some degree) I think investing can only be beneficial in the long run.

As long as the world population grows there will be growth. People need to consume. The population of Africa will double by 2050 and the wages in China and India are growing…

All these people consume and will want to raise their living standards!

Inflation

Another reason to invest your savings is to protect them from inflation. It’s hard to tell the level of the real inflation, since the “reference basket” that is used to determine that is not really representative in my opinion. I’d estimate it to around 2% per year in Germany.

That means: Money that is stashed in your bank account loses 2% per year without you doing anything!

So you could also say: It’s too risky to NOT invest your money.

Returns

A well-diversified global stocks portfolio has an expected average yield of a bit more than 5% per year after inflation and taxes over the long run. That doesn’t sound much at a first glance but much better than guaranteed -2% annually, right?

Some statistics

The MSCI ACWI (All Country World Index), which is a global stock market index which covers about 85% of the global investable equity opportunity set (it lacks the small caps) has performed with 7.86% annually since 1987-12-31.

With an impressive maximum drawdown of around 58% in the global financial crisis between October 2007 and September 2009.

You see it has fully recovered this drop in the meantime. That means if you were invested since 1988 you would have your 7.86% annual yield even with all the bad years included (there was not only one crisis in this period).

However I was only two years old at the start of 1988… So let’s look at a more recent time period, where I or other people at my age would actually have been able to invest:

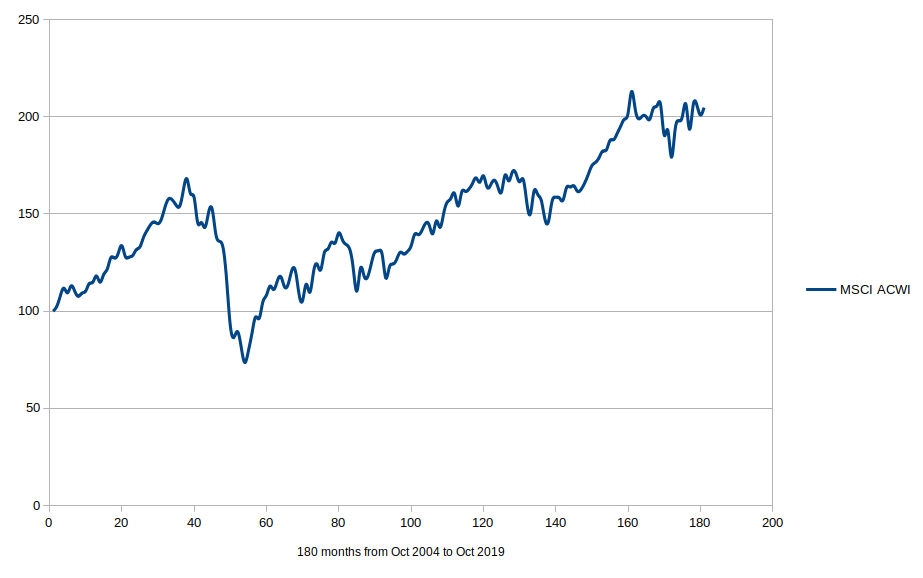

In the last 15 years, the time between October 2004 and October 2019, the gross returns of the MSCI ACWI were like this:

If you would have invested 100 $ you would have made 302 $ out of it in this 15 year period.

This is actually a bit below the historical average annual return of that index, but hey, you tripled your initial investment! And the big crisis was in that time frame too!

Important: Consider the dividends too!

When you look at stock market charts you have to be careful whether they include the dividend payouts (performance charts) or not. As I mentioned above in the 15 years you would have tripled your investment (100 $ -> 302 $) but when you take the data from the chart it looks like this:

You see you’ll be roughly at 210$ dollars because the dividends are excluded there.

(Note: All data taken from the MSCI ACWI factsheet on the MSCI homepage.)

How much should you invest into the stock market?

This is highly individual and depends on your personal needs/behavior and preferences.

If you can’t sleep without having more than half of your savings on your normal bank account that’s OK. Just remember that only the money you’ll invest will bring yield.

I can tell you what I personally do: I have an “emergency fund” of about 3 net monthly salaries. This is for unexpected things like when the car or the heating breaks.

Then I usually have 2 monthly net salaries on the bank account which are used to cover the day-to-day needs, pay bills and mortgage.

Everything else goes to the stock market!

That said my savings rate is not very high as the main income earner of a family with a mortgage to pay off. But it’s about 20%. As I said I won’t get rich with it, but also not die poor…

And in which products do you invest?

The simplest way to get your coverage of the global market capitalization are funds.

But not mutual funds or something like that. These have high total expense ratios and more than 85% underperform the market indices over the long term.

I prefer index-tracking ETFs. These are Exchange Traded Funds which track an index. They do so by buying all, or a representative portion of the shares which are contained in a stock market index.

(There are synthetic ETFs too, which achieve their performance using swapping contracts with counter parties, but let’s ignore that for now).

These have a lot of benefits:

- No manager is needed, since tracking can be done by algorithms alone.

- There are no emotions involved, as the ETF is a stupid construct:

It follows its index up- and down. It never decides “Hmm I think this particular stock will perform great let’s buy more of it.” Or “This one is bad I’ll get rid of it.”

Simple. Stupid. Like programmers love it. - In contrast to mutual funds which usually have fees of 1-3% of the total value per year an ETF is usually in the 0.2% area.

There are distributing and accumulating ETFs out there. The distributing ones are forwarding the dividends to you. The accumulating ones reinvest them automatically into more shares.

What is better depends on your situation and taxation laws.

But while you are still saving you should re-invest the dividends to have these snowballing too.

I can’t and I won’t recommend individual products here. Just aim to cover a big portion the market capitalization.

Whether you do this with an mixture of MSCI World (contains only developed countries) and MSCI Emerging Markets ETFs, choose a simple MSCI ACWI ETF or include the smaller companies (using *IMI indexes) for a even better coverage is in your hands.

I personally use an ETF on the FTSE All-World Index (informed people know the individual product now 😉 ) for investing about 70% of my savings.

Why only 70%?

Well I like to diversify even more. Across asset classes.

I have some real estate investment trusts (REITs but also as ETFs, no individual stocks) and an alternative strategy in my portfolio.

Important: I don’t expect higher returns than with the global stock market here!

I just hope it pays out having assets with lower correlation (REITs) or negative correlation (alternatives) with the stock markets to reduce the maximum drawdown in a financial crisis.

And thus having a faster recovery by doing opportunistic re-balancing.

But that’s a different thing. For that you need to have more information (i.e. read books about it/ do some analysis yourself) and have to be more “active”, in terms of re-balancing and other things, than would be necessary with “passively” holding a global stock market index-tracker ETF.

Also it’s doubt-able if it pays out having this diversification. I’ll try it, we’ll see what happens 🙂

The moral implications of investing into the stock market

Some people are not investing into index funds because of moral implications, but I think most of them are just not well-informed.

Yes, the indices contain shares of controversial companies like weapons manufacturers, coal mines, tobacco, alcohol etc.

But there are two reasons why this doesn’t matter (much)…

First of all: The ETF don’t buy these shares at the IPO (Initial Public Offering) but when they are added to the index. So the companies don’t get any of your money directly. The fund buys these from other owners!

In my opinion it is much better to take the earnings/dividends from a coal mine and use them to pay your electricity bill, which at least in my case is 100 % renewable energy. This way you can direct the flow of your money directly as you wish. And if the renewable energy companies will be more profitable in the future even better: They get added to the index automatically and will replace the coal mine as soon as they reach the necessary market capitalization (and the coal mine loses its portion of it)!

Second reason: If you don’t invest your money because of these reasons your bank will. It is no secret that the biggest German banks are heavily invested in loans and corporate bonds of controversial companies, like weapon manufacturers. So they take your money anyway and put it to work there! You only give up control, if you don’t invest it yourself!

Noticed the “much” in the section above? I said it doesn’t matter much. There is a minimal benefit the company still has when you invest in index funds: The price per share will go up due to demand and this will give them opportunities like being able to get better interest rates for their loans.

But the effect the passive private investors have on this is negligible.

Summary

For a lot of people out there I believe some exposure to the stock market using a world-wide diversified stock market index ETF would solve or at least greatly reduce the worries about their retirement savings.

There will be phases where the worth of your depot is down 50% or even more.

However in the long run you should only win if you never stop to “buy and hold”.

If you have questions you can ask me of course!

But, as I said, I’ll neither convince you to do anything, nor recommend any individual broker or product.

I can tell you what I do. Go inform yourself! It’s not rocket science. In the end it’s your risk!